Also noteworthy is the $15k refund for $0 of labor income, thanks to the $3k/kid fully refundable CTC. Until you do the math, you’d never realize that moderate income people face higher effective tax rates than the wealthiest people in America. Ideally I’d get down to $25.5k of taxable income through utilization of HSA/401k/401a/403b/457. If I had 5 kids and had a gross income of $60k, I’d shelter as much income as possible to avoid the 33.1% effective rate. This household faces marginal federal tax rates of 33.1% as they slide down the EITC ramp and simultaneously enter the 10% federal bracket after exhausting the standard deduction. Not too shabby! The downside of the phase-out of free money is high marginal rates. At $15k of taxable income (after 401k’s, HSA’s, etc), they get a refund of $21.728 for a net income of $36,728 (before accounting for food stamps, Medicaid, etc). Here’s how taxes look for a MJF family with 5 kids. Here’s how taxes look for a MFJ household with zero kids.

Your welcome to expand the collapsed cells to dig into the underlying calculations. In April of 2021, you’ll get your income – tax liability returned to you in the form of a massive tax refund….the largest of your life.

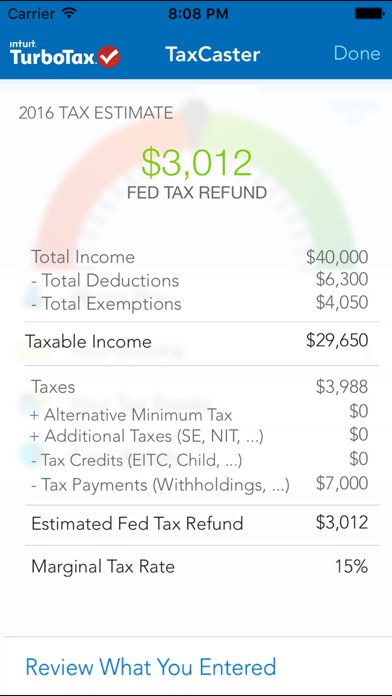

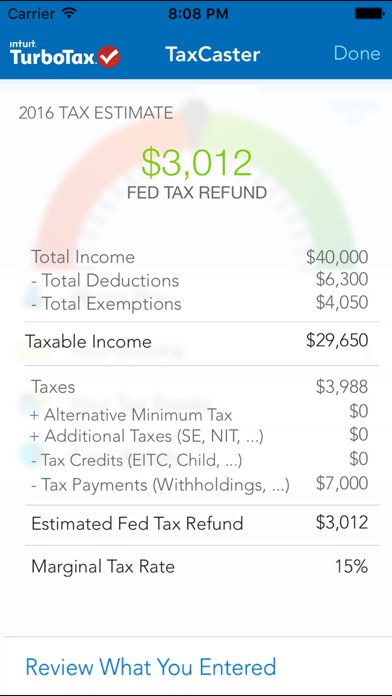

Want a big refund? Withhold 100% of your paycheck as federal & state tax withholdings. Your 2021 tax refund = 2021 withholdings – 2021 tax liability. Look up your taxable income in the table/chart to see your tax liability. If you made $100k gross but contributed $19.5k to a Trad 401k, paid $12k in healthcare premiums, and contributed $7,200 to an HSA, then your taxable income is $61,300 (=100k-19.5k-12k-7.2k). Then, compute your taxable income on your own. Further, a non-deductible IRA contribution should obviously converted to Roth (a-la backdoor Roth). If you’re in this boat, simply enter the deductible portion in my sheet. I used to calculate this, but I decided to ditch it this year to simplify the spreadsheet given that AMT is practically dead.  AMT (because Trump essentially removed it for most people). Stuff my spreadsheet does not attempt to calculate: Effective marginal tax rates for $1 extra labor income. Standard vs Itemized deductions (including $10k SALT cap). Single, Head of Household ( new this year!), Married.

AMT (because Trump essentially removed it for most people). Stuff my spreadsheet does not attempt to calculate: Effective marginal tax rates for $1 extra labor income. Standard vs Itemized deductions (including $10k SALT cap). Single, Head of Household ( new this year!), Married.

Stuff my spreadsheet handles (or attempts to):

With a 2% dividend yield, this implies that one could qualify for the EITC with $500k of taxable investment balances. Investment income threshold was increased from $3,650 to $10k!. For those with high enough incomes, it reverts to the same $2k/kid credit with 5% phaseout at $200k for HoH and $400k for MFJ.  Phases out at 5% above $150k of income for MFJ, $112.5 for HoH. Child tax credit (temporary changes for 2021 only):. Well, thanks to the $1.9B Coronavirus stimulus bill (#3), there are some pretty major changes to the tax code this year:

Phases out at 5% above $150k of income for MFJ, $112.5 for HoH. Child tax credit (temporary changes for 2021 only):. Well, thanks to the $1.9B Coronavirus stimulus bill (#3), there are some pretty major changes to the tax code this year:

0 kommentar(er)

0 kommentar(er)